individual tax -

basic misconceptions

BRIEF SUMMARY OF THE EPISODE

A lot is going on in today’s episode. least of which is our main topic. We are into the 2nd week of our Drunk Christmas in July. Dan is on the hunt for a co-host to join us at Xerocon whilst Tim is off living his #bestlife in Europe. Speaking of Xerocon, we need a new slogan for our merch. Each year, we unveil the new merch at Xerocon. Is this the year you make the cut?

But the real reason you are all here is that Dan is on the Apps. it’s come, the time is ripe to get onto the dating apps. Oh, and we also dispel some Individual Tax myths as well.

BULLET POINTS OF KEY TOPICS & CHAPTER MARKERS

-

-

- Tim & Danlow [2:35] Welcome to the 2nd week of Drunkmas! Christmas in July is here. Write in and you can win a T-Shirt. We need a new slogan! Hit us with your best one-liners. We are on the hunt for a Tim replacement whilst he is enjoying his Hot Boy European Summer.

Tim has uncovered that Dan is on Bumble! The joy is real for Tim right now. Dan is awkwardly putting himself out there on “the apps” and is showing his age.-

-

- Community Update [12:06] Our very own Mortgage Choice Wyong & Mortgage Choice Erina are hosting an event with Blue Wealth Property!

- Tim’s Tight Ass Tip [15:03] Don’t trust the prices of your meal delivery services. Check directly with the website when ordering food. Which coincidently, may have its own delivery service.

-

When you travel, book an Airbnb, it’s your home away from home.-

-

- Main Topic [19:20] How does individual tax work? The Misconceptions:

- Tax Brackets – The misconception here is that individuals pay tax at a flat rate. Rather, you will pay tax as an individual as a % for every dollar above a threshold. Eg 0% for every dollar between $0-$18,200, then 19% for every dollar above $18,200 and up to $45,000 and so on as per the table below.

- Main Topic [19:20] How does individual tax work? The Misconceptions:

-

.

-

-

-

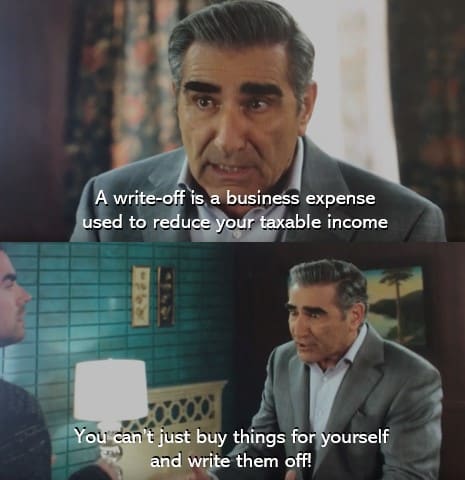

- Tax Write-offs – Everyone loves a write off! But deductions don’t directly reduce the tax you might owe. They reduce your taxable income, which saves you the highest % of tax rate you are paying per dollar – E.g. if you earn $100,000 then every $1 of deduction will save you 32.5% (32.5cents) in actual tax.

- Tax offsets – These often do directly reduce your tax payable. Offsets relate to specific legislative rulings around a level of income, your age, an industry you work in or where you live. This is not related to what you have spent money on, but rather a group you are a part of. eg:

- Private Health Insurance

- Aged Pension

- Armed Forces

- Rural living

- Other types of income. Capital Gains, dividends, sole trader income, Cryptocurrency, etc. This then Circles back to the tax brackets. You add the capital gains income to your employment income, which will then be lumped together and taxed based on the bracket that applies to you.

-

-

- Other Thing [37:48] Tearless onions! This is a thing! Who knew, or even thought to ask for it?

-

Speaking of scientific breakthroughs, this is of a real benefit. There is a breakthrough with glaucoma, there is now testing available to be able to get ahead of it becoming a problem. -

RESOURCES & LINKS